Case study – skyrocketing prices and limited availability of metals in 2022

Difficult situation on the metal market in 2022

Automotive battery industry is one of many branches that underwent difficulties during the last year due to the war in Ukraine. Unprecedented prices increases, apart from oil ang gas, affected also the metal market. The prices of copper reached an unparalleled level of 10,7 thousand USD per ton. The London Metal Exchange has never faced such an increase in its 145-year-old history.

Additionally, global supply chains are dependent on Russian and Ukrainian export of precious metals as well as so-called EV metals used for the production of electric vehicles batteries. One of such metals is lithium, which is a key material not only for the EV industry but also for widely understood global industry of renewable energy.

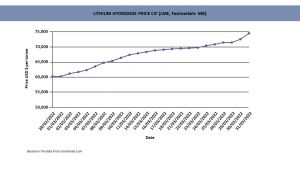

High prices of raw materials influence the prices and availability of chemical compounds obtained from them. A good example is lithium hydroxide monohydrate used in lithium-ion batteries as well as in lubricants, glass industry, ceramics and the production of catalytic converters. Many European manufacturers who use this chemical compound in their production processes encountered enormous problems with its availability and high prices. Fortunately, regular Cortex Chemicals customers were spared these difficulties.

Solution for Cortex Chemicals regular customers

As a professional distributor with long-time experience on international markets, we maintain constant cooperation with leading producers of raw materials of strategic importance. It enabled our company to keep the continuity of chain supply even in such difficult market realities. Our customers receive regular supplies of lithium hydroxide monohydrate (and other strategic raw materials) at competitive prices, which saved them from the necessity of reducing production.